What do the best PayPal alternatives offer that PayPal doesn’t?

In this post, you’ll find 5 well-known contenders and 27 under-the-radar options to help you pinpoint the payment platform that makes the most sense for you.

But before we dive in, just a quick note…

The purpose of this post isn’t to reject PayPal or endorse any specific alternatives to PayPal. We want to help you get clear on what you need and which payment gateways can best meet those needs for your business.

With that out of the way… let’s get to the list!

5 Biggest Alternatives to PayPal

We’ll start with the five most popular and most widely accepted PayPal alternatives — all of which you’ve probably heard of.

1. Amazon Pay

Amazon Pay is easy to use, especially if you already have an Amazon account. But you will need some programming knowledge to integrate the payment platform with your existing CRM.

Given Amazon’s popularity with shoppers, having this option available to your customers can boost your conversion rates.

Best for: U.S.-based online businesses with an ecommerce platform — especially those with an Amazon seller account.

Pricing: Like PayPal’s, Amazon Pay’s fees are transaction-based.

2. Apple Pay

Built into Apple devices, Apple Pay powers Apple Cash, which works in a similar way to a PayPal balance or debit card.

Apply Pay is accepted at over 85% of U.S. retail businesses and works wherever contactless payment is enabled.

Best for: Anyone using Apple devices (iPhones, iPads, Macbooks, etc.) to shop online or collect payments from others.

Pricing: No fees for using Apple Pay, Apple Cash or your Apple Card.

Apps: Apple Wallet (iOS)

3. Google Pay

Here again, customers can use payment information stored in their Google account (something they’re probably already logged into) to shop online using Google Pay, using any Google-ready device.

Google Pay Send also allows users to attach payments to Gmail messages, without any added charges (PayPal charges 2.9%).

Best for: Sending and receiving free, fast and easy payments with a well-known, user-friendly brand.

Pricing: No fees for using Google Pay

4. Quickbooks Payments

QuickBooks Payments is the best PayPal alternative for those who want seamless integration with their QuickBooks accounting.

If you’re already a fan of Intuit products, you’ll enjoy the Quickbooks payment app, which enables invoicing and payment with a mobile device.

Best for: Freelancers/businesses looking for a payment solution that integrates with QuickBooks.

Pricing: See their pricing page for plans and take it for a free test drive (no credit card required).

Apps: Android (iOS has QuickBooks Accounting and QuickBooks Self-Employed)

5. Shopify Payments

Shopify Payments allows you to accept credit card payments directly at low rates. Use the dashboard to track your balance and payment schedule. And get email alerts whenever new funds reach your account.

Best for: Ecommerce business owners using the Shopify platform.

Pricing: Basic Shopify ($29 per month + fees) and Advanced Shopify ($299 per month + fees). Try it free for 14 days (no credit card required).

Apps: Shopify: Your eCommerce Store (iOS / Android) and Shopify Point of Sale (iOS / Android)

27 Lesser-Known PayPal Alternatives to Consider

Now that you’ve looked through the top five PayPal competitors, let’s check out 27 lesser-known options worth considering.

1. 2CheckOut

Trusted by 20,000+ industry leaders in over 180 countries, 2CheckOut specializes in making international ecommerce easy and mobile-friendly — with eight payment types, 15 languages and 87 currency options.

Best for: Businesses looking for a single payment platform that works with many currencies, countries and languages.

Pricing: Three pricing plans:

- 2SELL: 3.5% + $0.35 per successful sale

- 2SUBSCRIBE: 4.5% + $0.45 per successful sales

- 2MONETIZE: 6.0% + $0.60 per successful sale

Apps: Not applicable.

2. Adyen

Widely recognized as the best PayPal alternative for eBay, Adyen’s payment platform is also preferred by some of the biggest names in tech, including Spotify and Etsy.

Pricing is transparent, and subscribers can safely accept payments from anywhere in the world, thanks to Adyen’s security features.

Best for: Business owners wanting omnichannel payment options, international ecommerce tools and a dedicated merchant account.

Pricing: $0.12 processing fee plus a fee specific to the payment method used.

3. Authorize.Net

Authorize.Net integrates well with PayPal, Apple Pay, and Visa Checkout, making it easy for you to accept electronic and credit card payments in-person, online or over the phone.

With a merchant account, you’ll get fraud detection, recurring billing, QuickBooks integration, an invoicing suite and 24/7 support.

Best for: Businesses based in the U.S., UK, Canada, Europe or Australia looking for top-notch customer support and security.

Check the pricing page for plans and rates.

App: Android

4. BlueSnap

BlueSnap’s API allows you to customize your checkout page and build your own subscription plans. Their payment solution offers 100 currency types and a payment experience in 29 languages.

Additional features include fraud prevention, chargeback monitoring and a reporting suite.

Best for: Tech-savvy online businesses looking for a full-service, highly customizable payment solution.

Pricing: Rates for U.S. businesses range from 2% plus $0.30 per transaction up to 3.7% plus $0.30.

5. Braintree

Unlike PayPal, BrainTree offers dedicated merchant accounts, which allow you to accept magstripe, chip card and contactless forms of payment — and to convert over 130 different currencies.

Braintree also easily integrates with PayPal, Google Pay, Apple Pay, etc., turning your payment platform into a user-friendly mobile POS system.

Best for: Very large businesses wanting the capabilities of PayPal but with a dedicated merchant account

Pricing: Standard (2.9%, plus 30 cents per transaction) or Custom

Apps: Not applicable.

6. Charge.com

Charge.com makes it easy to accept all types of credit card payments — using a POS terminal, virtual terminal or online shopping cart.

It doesn’t offer a lot of additional features. But for simple, affordable credit card payment processing, it’s worth a look.

Best for: Simple, safe, low-cost credit card payment processing with a dedicated merchant account.

Pricing: As low as 0.25%, with transaction fees as low as $0.15.

Apps: Not applicable.

7. Dwolla

Dwolla specializes in ACH payments, allowing you to connect directly with the ACH network. And its white-label API lets you customize checkout for better branding.

Want to read more about how to build an amazing brand that attract your ideal customers? Read this post.

With a 99.9% uptime, transparent pricing, top-notch security and hands-on customer support, Dwolla is designed for businesses with a high volume of bank transfers.

Best for: U.S. businesses dealing with a high volume of ACH payments.

Pricing: “Pay-As-You-Go” ($0.05/transfer) or “Launch,” “Scale,” or Custom.

Apps: Not applicable.

8. FastSpring

FastSpring is a full-service, easy-to-use global ecommerce platform, available in 200+ regions and supporting 20+ currencies and 15+ languages.

Its best features include fast payments on all customer orders, different checkout options and customizable storefronts — with website, mobile and in-app functionality that integrates easily with stores.

Best for: Tech-savvy global ecommerce businesses looking for a full-service, customizable payment platform.

Pricing: Submit your work email to negotiate pricing. You can also create a free account and request a demo.

Apps: Not applicable.

9. Fattmerchant

Stax Pay by Fattmerchant is a flat-rate subscription-based payment processor for high-volume ecommerce businesses. Some of its best features include chargeback monitoring and QuickBooks integration.

Transaction fees match the true cost of interchange, making it a more affordable option for higher-volume businesses.

Best for: High-volume ecommerce businesses looking for a flat-rate payment solution with QuickBooks integration.

Pricing: Payment plans for small businesses, large businesses and SaaS platforms.

App: Android

10. Instarem

Founded in 2014 to speed up international payments and cut the costs usually associated with bank transfers, Instarem grew quickly to meet demand.

Its best features include fast, secure payment transfers, excellent 24/7 customer service and low exchange rates.

Best for: International ecommerce businesses that prioritize fast, easy and secure transactions in a wide selection of global currencies

Pricing: Fees are transaction based and vary from country to country. Contact them for more information.

11. Klarna

Klarna gives your customers more flexible payment options — like 30 day payment plans, customer financing or payment in four installments.

Some of its more unique features include the ability to integrate with ecommerce platforms, apps and social media sites.

Best for: Businesses that want to offer their customers unique payment options, such as customer financing and paying in installments.

Pricing: Pricing will vary based on customer location and the payment solutions you implement.

12. Merchant Inc.

With over 25 years of experience, Merchant Payment Services is a top-rated payment processing service that takes pride in its ability to eliminate up to 95% of the fees associated with online, mobile and in-person payments.

They also stand out for their responsive 24/7 customer service.

Best for: Ecommerce businesses that want to save money on top-of-the-line payment processing without sacrificing customer service.

Pricing: Contact them for information on pricing.

Apps: Not applicable.

13. Payline

Currently available only in the U.S., Payline stands out for its lower cost and greater flexibility (compared to PayPal) with in-store payments.

Add its supporting hardware and Payline is well-suited to brick-and-mortar stores with a high volume of in-store transactions.

Best for: U.S. based businesses looking for an affordable, all-in-one merchant service provider that comes with a dedicated merchant account.

Pricing: Use their on-site calculator to estimate your monthly charges.

14. Payoneer

With Payoneer, you can send and receive payments for free — as long as your customer / vendor is also a subscriber — making this an ideal platform for B2B payments.

Payoneer operates in more than 200 countries and offers two types of accounts. It also provides tax administration tools, invoicing, and a debit card.

Best for: Small to medium-sized businesses looking for a low-cost payment solution for B2B commerce.

Check their pricing page for fees.

15. Paysera

If you’re looking for an international payment solution that enables customers to pay by card, via their bank, or even by SMS, Paysera is one of the best options for businesses based in Europe.

Features include a contactless debit card, business bank account and a mobile payment app (for Android).

Best for: Europe-based businesses looking for a full-service alternative to PayPal.

See the pricing page for fees. Paysera also offers currency exchanges, and low-cost global transfers.

App: Android

16. Popmoney

If ACH payments are the only kind you send and receive, Popmoney’s low-fee platform is one of your best options, as long as you don’t exceed their limits.

Send money securely from a bank account to anyone with an email or phone number; or use the same to send a payment request.

Best for: Smaller B2B and service-based businesses looking to lower costs for ACH payments.

Pricing: $0.95 to send or request money

17. ProPay

ProPay offers both in-person and online payment processing for credit card payments and ACH transfers.

All of Propay’s plans enable you to accept credit card payments in a variety of ways, all while keeping your data safe with end-to-end encryption.

Best for: Businesses looking for multiple ways to accept payments securely through one trusted service.

Check pricing for setup, annual and hardware costs and transaction fees.

18. Skrill

A Skrill business account gives you access to over 100 card and local payment methods, 40 currencies, and simple integration — along with advanced analytics and reporting, chargeback protection and fraud management.

It’s a great low-cost option for private users, especially gamers and those who deal in cryptocurrencies.

Best for: Small businesses or private users looking for a low- or no-cost way to send and receive payments.

The pricing page lists fees and charges.

19. Square

Not only does Square offer a variety of payment processing solutions, it also provides some of the best hardware to go along with it.

Add its free POS software, and Square is one of the best payment solutions for brick-and-mortar businesses of all sizes.

Best for: Businesses (in the U.S., UK, Canada, Australia, and Japan) focused on selling in-person and looking for a full-service, integrative POS system.

Check their pricing page for transaction fees.

App: Android

20. Stripe

Stripe takes pride in its “tech-first approach” to payments and finance and is one of the best options for large ecommerce businesses.

Its API allows users with some tech know-how to customize their payment solutions for better functionality and branding.

Best for: Tech-savvy U.S.- and Canada-based businesses looking for a flexible API (application programming interface) for greater payment customization.

Check the pricing page for fees and to learn about their custom pricing option.

21. Veem

Veem uses blockchain to process digital transactions at no cost. Send, receive and track payments domestically or internationally while saving your clients money.

Operating in more than 110 countries, Veem automatically syncs with your preferred accounting software (including QuickBooks Online and Xero).

Best for: Ecommerce businesses wanting to send, receive and track digital international wire payments at no cost.

Check out their pricing pages for Cross Border, Local U.S., and Local Canada.

Apps: Not applicable.

22. Venmo

Once you integrate Venmo with either Braintree or PayPal Checkout (adding Venmo as a payment option), you’ll enjoy the social aspect Venmo brings to your checkout page.

Venmo serves as not only a digital wallet but a social commerce platform — with instant messaging, data encryption, web and mobile apps and social media syncing.

Best for: Businesses and freelancers interested in upping their social commerce game.

See their pricing for fees and charges.

23. Viewpost

Viewpost makes it their goal to minimize waste and increase visibility for B2B transactions.

Each time they receive payment instructions, they convert suppliers to receive electronic payments. Or, if that isn’t possible, they send a check, taking that off your to-do list.

Best for: Businesses and freelancers wanting to increase payment efficiency, eliminate the need to print checks, and earn cash back on their B2B spending.

Pricing: See invoicing and payments for small(er) businesses.

24. WePay

WePay is designed to serve businesses that operate software platforms and want to enable their users to send and receive payments.

WePay works as both a payment processor and a platform partner and can participate in fundraising (including crowdfunding), accounting and event management, as well as standard payment solutions.

Best for: SaaS businesses looking for a flexible, full-service, integrated payment solution.

Pricing: Contact their sales team for information on plans and fees.

Apps: IOS / Android

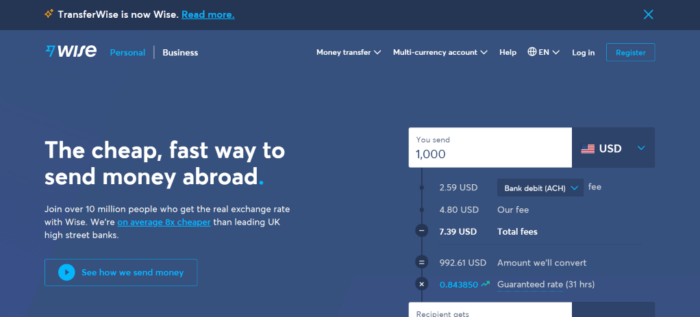

25. Wise (fka TransferWise)

Wise (formerly known as TransferWise) is a fixed-fee approach to processing international payments and offers Xero integration, batch payments and an open API.

Their multi-currency borderless account helps you send, receive and spend money (EUR, USD, AUD, or GBP) across borders with minimal fees.

Best for: International businesses and freelancers looking for the cheapest way to transfer money (from one bank to another) across borders.

Pricing: Fixed fee of $1.40 (which varies by currency).

26. Worldpay

As a Worldpay subscriber, you’ll have access to all the resources provided by World Pay UK, WorldPay U.S. and WorldPay Global — including online card payments, gateway services, and data analytics.

With over 300 payment methods available, they’re uniquely suited to helping you find the best tools and solutions for your business.

Best for: Growing and international businesses looking for a full-service payment platform.

Pricing: Contact them to request information on fees and other costs.

Apps: Not applicable.

27. Zelle

Backed by over 30 major U.S. banks, Zelle makes it quick, easy and free to send and receive money using their app.

Transfers to and from banks using Zelle often take only minutes; transfers with unsupported banks take longer. Limits on transfer amounts depend on the banks involved.

Best for: Individuals in the U.S. looking for an easy and free way to transfer funds from one bank account to another.

Pricing: No fees.

Which PayPal Alternative Will You Try First?

Now that you’ve looked through all the PayPal alternatives listed above, which ones stood out for you?

Share your favorites in a comment below. What drew you to them?

You won’t make the money or have the impact you desire without building the business you’re truly meant to build. Luckily, I’ve got a FREE 60-minute Masterclass with the 7 things you must have to identify your most profitable & fulfilling dream business.

Love it? Hate it? Let me know...

-

OMG! This stuff boggles my mind. I have no idea. I have PayPal & Stripe. I have not started collecting any money yet. I have a coaching business, so I will offer my services, 1:1 coaching and packages, workshops, VIP Days and maybe Retreats. Some costs will be one time full pricing and others will have payment options. Since I have never done this I don’t have a clue which is best. I hope my audience is global but I am in the US.

Kim Chatman. (Any feedback?)-

My personal opinion based on experience:

I use PP now, but after 20 years of having no problems, no charge backs, nothing negative etc, I get limited and 1 month of frustration, loss of business and etc, and many others are experiencing long delays, as well as losing accounts altogether, while scamsters are using the platform to get rich.I have also used Stripe and Square, and Stripe is now the main processor in my stores, and PP is only there as an alternative.

My advice, use anything but PP, and I know a lot of people use, or prefer it, but try to use it minimally, or not at all. People STILL buy! If they want your product, they will buy it with the processor of Your choice.PP will eventually get around to creating nightmares for all members, whether they have stellar accounts, or are scamming folks, and there are many folks using it to do just that.

So my advice is set yourself up with Stripe also, so you have a backup if you are using PP as your main.-

Great, thoughtful advice, Angie! Thanks for sharing your experience and recommendation.

-

-

Leave a Comment